Unlocking the Power of Outsourced Bookkeeping: Your Essential Financial Support, On Demand

Unlocking Efficiency: The Benefits of Outsourcing Your Monthly Bookkeeping

Bookkeeping forms the cornerstone of every successful business, yet managing it in-house poses significant challenges for small business owners. From consuming valuable time to incurring high costs, the complexities can often outweigh the benefits.

In reality, maintaining bookkeeping employees can cost businesses more than anticipated, with additional expenses like benefits and idle time contributing to over 50% of their stated wage. By outsourcing these tedious tasks, you not only alleviate financial strain but also free up precious time to concentrate on core business operations.

For many small business owners, outsourced bookkeeping emerges as the ideal solution. Here’s why it might be the perfect fit for you too:

- Cost Savings: Reduce labor costs associated with in-house bookkeeping and benefit from a more cost-effective solution.

- Expertise: Partner with professionals possessing advanced expertise in bookkeeping, ensuring accuracy and compliance with industry standards.

- Scalability: Adapt bookkeeping services according to your business needs, scaling up or down as required for optimal efficiency.

- Time Allocation: Reclaim valuable time for essential business tasks, redirecting focus towards strategic growth initiatives.

- Streamlined Operations: Bid farewell to time-consuming data entry tasks, allowing for smoother and more efficient workflow.

- Accuracy: Ensure your financial records are consistently up-to-date and accurate, providing a clear understanding of your business’s financial health.

Experience the transformative benefits of outsourced bookkeeping and unlock greater efficiency in managing your business finances.

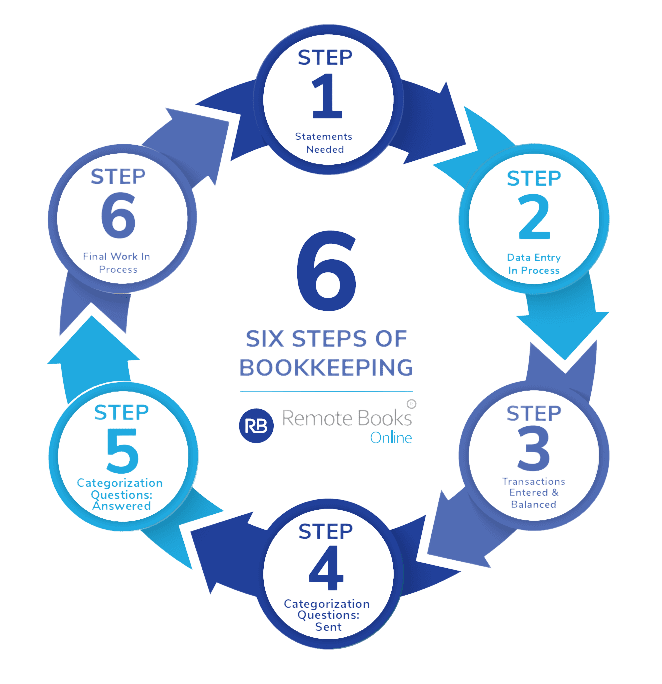

Understanding the Inner Workings of Outsourced Bookkeeping

Step 1: Submission of Statements

Simply provide us with all your financial statements, including bank, credit card, and loan statements. For added convenience, you can grant us accountant login credentials to streamline the process further.

Step 2: Data Entry

Once we have your statements, our team diligently enters the relevant data for reconciliation.

Step 3: Balancing Books

We meticulously balance your books, ensuring that your beginning and ending statements align accurately with your bank records.

Step 4: Ongoing Communication

As needed, we may seek clarification on certain transactions, especially during the initial stages of our collaboration. With time, our understanding of your business grows, minimizing the need for inquiries.

Step 5: Providing Additional Information

The more insights you share about your transactions, the smoother the reconciliation process. Timely responses to our queries expedite monthly operations.

Step 6: Delivery of Comprehensive Reports

Receive timely and well-organized Profit & Loss statements and balance sheets, ready for tax preparation or further analysis by your accountant.

Experience seamless outsourced bookkeeping with our step-by-step process, ensuring accuracy and efficiency at every stage.

The Zero Error Model: Ensuring Precision in Outsourced Bookkeeping

In the realm of outsourced bookkeeping, precision is paramount. Our Zero Error Model is not just a philosophy; it’s a commitment to excellence driven by core competence and unwavering incentives

Dedicated Bookkeeper

Experience the unparalleled advantage of having a dedicated, certified bookkeeper exclusively assigned to your account. With undivided attention and expertise, this individual, alongside the lead accountant, meticulously reviews your account, conducts thorough categorization, and initiates the bookkeeping process. This dedicated model not only mitigates errors but also enhances efficiency by eliminating the possibility of brain drain.

Dedicated Bookkeeper

Experience the unparalleled advantage of having a dedicated, certified bookkeeper exclusively assigned to your account. With undivided attention and expertise, this individual, alongside the lead accountant, meticulously reviews your account, conducts thorough categorization, and initiates the bookkeeping process. This dedicated model not only mitigates errors but also enhances efficiency by eliminating the possibility of brain drain.

Effective Communication

Your lead accountant serves as the primary liaison for all accounting queries, offering prompt assistance via phone or email. Supported by our dedicated team, we guarantee a same-day response to address any concerns. Moreover, quarterly review meetings are scheduled to provide comprehensive insights into your financials, facilitating adjustments and clarifications as needed.

Tax Ready Financials

Experience peace of mind with our comprehensive Year End Financial Package, meticulously organized to meet your tax filing requirements. In collaboration with your CPA, our lead accountant ensures timely delivery and seamless coordination, sparing you the hassle of intermediation.

Back Bookkeeping

Your lead accountant serves as the primary liaison for all accounting queries, offering prompt assistance via phone or email. Supported by our dedicated team, we guarantee a same-day response to address any concerns. Moreover, quarterly review meetings are scheduled to provide comprehensive insights into your financials, facilitating adjustments and clarifications as needed.

Tax Ready Financials

Experience peace of mind with our comprehensive Year End Financial Package, meticulously organized to meet your tax filing requirements. In collaboration with your CPA, our lead accountant ensures timely delivery and seamless coordination, sparing you the hassle of intermediation.

Experience the Zero Error Model with Remote Book-keeping Online—where precision meets proficiency in outsourced bookkeeping.

Experience Seamless Bookkeeping with Remote Book-Keeping Online Today

Check Bookkeeping off Your To-Do List

When you delegate bookkeeping tasks, you gain more time to focus on your business.

- No more late nights spent on data entry and tedious bookkeeping tasks.

- Eliminate the need for training employees in bookkeeping, saving time and resources.

- Enjoy up-to-date and accurate books at all times.

- Liberate your time to concentrate on growing your business.